Risk Department

Mr.

Chief Risk Officer

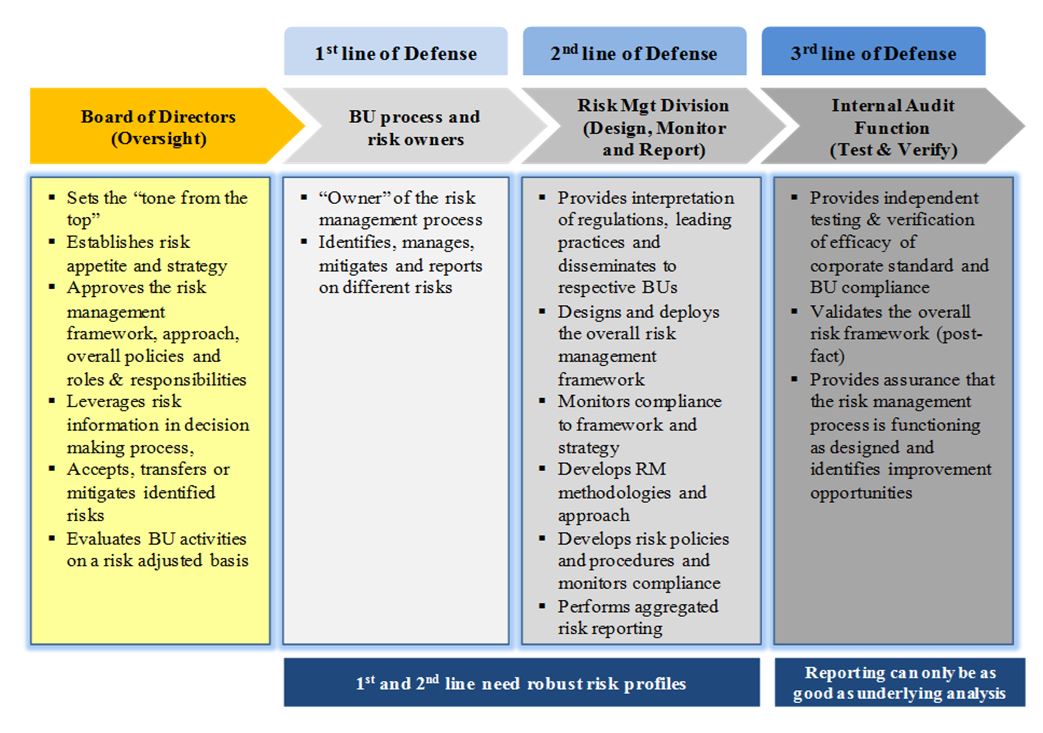

Risk Governance Framework of Pashtany Bank

The risk governance framework of Pashtany Bank is based on the ‘three lines of defense’ model with an oversight by the Board of Supervisors (BoS). The responsibilities for risk management function are shared among business units as a first line of defense, risk management as a second line of defense and internal audit as a third line of defense, as shown in the figure below:

Risk Management Department Profile

Pashtany Bank Risk Management Department (RMD) is sufficiently independent of the business units whose activities and exposures are reviewed by risk management function. RMD has access to all business lines that have potential general material risks. The risk functions at Pashtany are centralized and specialized. Within this Department, staff is specifically employed to carry out risk management functions based on RMD policies and procedures. By provision of sufficient seniority and complete segregation of duties (from front-end or back-office functions), The work of the centralized RMD relies also on communication with responsible people from the individual business and support units. However, to ensure its independence from risk-taking and related support units, RMD works with its own measurement tools, gets its own data and controls independently from controls done in the front-end units.

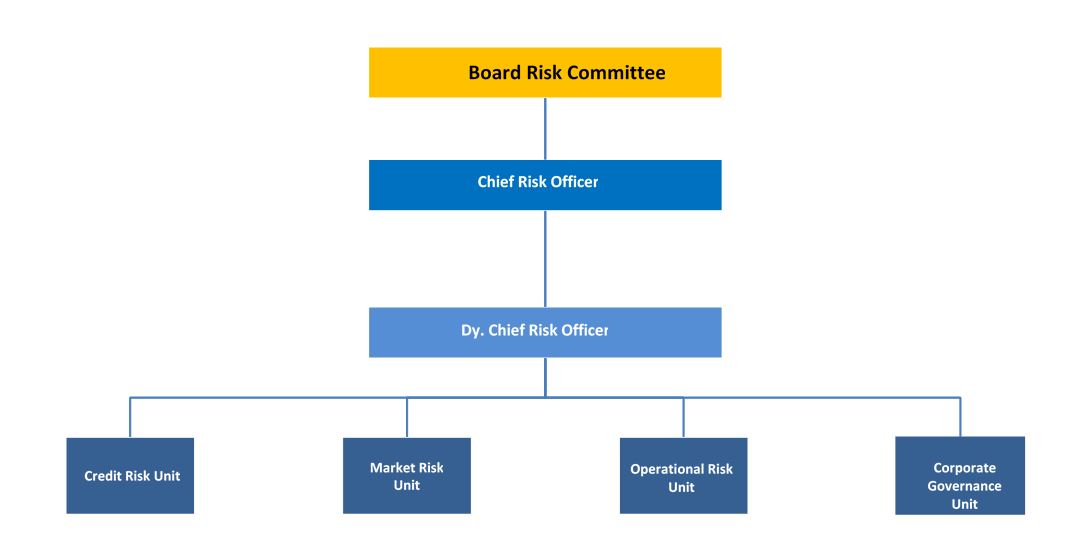

The functional structure of RMD